Disclaimer: This blogpost is for informational purposes only and should not be considered personal financial advice. The author is not a licensed financial professional and will not be held liable for any decisions made based on the information provided. We simply want to take you along the journey we are making ourselves. Investing comes with inherent risks and you should perform your own research before making any investment decisions.”

Executive Summary:

Several tailwinds due to digitalization of the sales process, consolidation of the broker market and ageing of the EU market (40% of brokers retiring over next years)

Well connected with all mayor distributors (Top-5 of Sparkassen, in a JV to consolidate the broker market, etc). Its mayor distribution partners own a share of the company. It is slowly establishing itself as an insurance network player, which will provide a strong moat and network effect

Management ownership, no dilution of shareholders over time and even some will timed acquisition & sales of own shares

Growth is visible (contracts with mayor players just started), however its still somewhat unclear on how much expense growth will be needed to support this

Conclusion: we agree on the potential for growth, but doubt if there will not be a higher need for expenses either. We start with a first position at around EUR 16/share and will await the Q3 results for further guidance (8th NOV). If FY23 EBITDA levels of EUR 12 mio are still within reach and growth is on track, this company is clearly worth a spot in our portfolio

Analysis:

Activities & strategy

JDC Group is an aggregator in the German & Austrian insurance & investment market. It has two business arms:

Its Advisory Segment, which provides pension and investment advisory services

And its Advisortech Segment, offering leading-edge consulting and administration technology

It developed its proprietary platform (iCRM) to administer & process financial products & insurance contracts. Note JDC does not manage these products themselves (its not an insurance company), it tries to position itself as a data processor and generalizer in the insurance sector (e.g. the Amazon for insurance products). It allows you to easily manage and compare insurance products on their platform and earns a fee for this service.

German banking & surely the insurance sector is notorious for being late in the digitalization cycle

JDC is building this market from both sides:

Making sure all providers are on your platform (e.g. the main insurance & investment companies like Allianz, Axa, …)

And providing them with sufficient sales channels showing them the need to be on their platform

But once this network is in place, is becomes a very powerful moat and a flywheel for further growth (i.e. network effect)

In terms of supply - JDC Group claims to have connections with +200 insurance companies. The reason these companies trust JDC is because they know customers on the platform are more sticky and easier to service.

In terms of distribution - JDC Group is working on all possible fronts:

It has technical platform to service the broker market

Including a white-label frontend webpage should brokers want to make use of it

Acquired the website ‘www.geld.de’ to be able to sell to customers directly

And operates a small scale sales operation for the wealth segment

Larger German financial institutions, ranging from the insurance companies behind the German savings banks (Sparkassen) like Provinzial and Versicherungskammer Bayern (VKB) to company in-house insurance brokers (eg Lufthansa / BMW / Volkswagen) are starting to adopt JDC’s platform or have already done so in the last few years. These clients are JDC’s major or key customers and focus for growth over the next years

Over the past years, JDC Group is executing nicely, although lots of contracts are still in the early phases. @Symmetry_Invest is following up on their commercial development and has a nice overview in its most recent note:

Existing contracts with Albatros (Lufthansa) and Finanzguru (Germany’s multi-banking app evolving into a finance platform with 1,5m users) are extended

Provinzial (services 110 Sparkassen in North & West Germany - potential of 100m customers) & VKB (services 90 Sparkassen in South Germany) recently signed up

Pilot project with R+V (3rd largest insurance group with 7% market share in Germany) is extended into a 4y full contract

JDC Group also has an ace up it’s sleeve. It’s majority shareholder Great West (see further) started the JV Summitas Gruppe with Bain and JDC Group (10% equity stake) to consolidate the German broker market. We see this happening in multiple countries (see UK for example), as brokers are faced with more & more regulation + large IT costs + 40% of brokers are reaching pension age. This makes it worthwhile to have a more centralized and larger organization to spread this fixed costs base over. The extra benefit for JDC (aside from a potential gain on the JV) is that each bought broker will be plugged on their platform.

And while running over this list, its nice to note no mayor collaborations have been terminated (technically ComDirect - the Direct bank from CommerzBank - stopped as a separate entity after restructuring within CommerzBank). On the contrary, it’s competitor Hypoport (large in Real Estate financing and associated credit-insurance) recently focused more on cost-control. JDC was able to hire off Marcus Rex (former Chief Sales Officer Insurance at Hypoport)

International expansion is not really large. JDC Group is active in Austria and has a small business in Czech Republic and Slovakia. But as JDC is only 0.5% of the insurance market in Germany, this is where the first focus lies.

Constant evolution of the company

Note the company goes back quite some time. It used to be known under the name ‘Aragon’ and was active in financial services, reaching about 1 mio customers over Germany, Austria and Eastern Europe earning mostly commission fee’s from servicing investment products to brokers. Given low interest rates, these products were diminishing in need. Additionally this business is less scalable (large & well trained sales network required to service the High Net Worth client asking for bespoke products). Hence the company reorganized itself in 2012 to focus on financial products via brokers and insurance advising, which brings it to its activities today.

Financial analysis

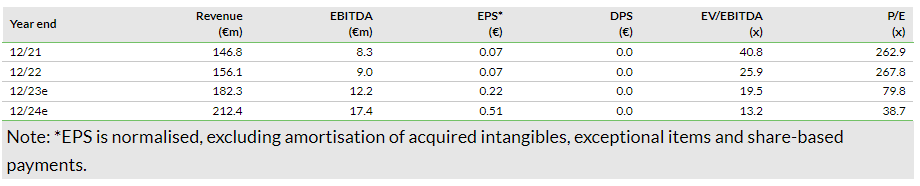

Note - there is follow-up on the company from Edison Group. Take into account they are Sell-Side analysts (paid by the company) when you read their reports

Half year 2023

Insurance business (AdvisorTech) growing thanks to additional contracts, finance business (Advisory) declining given general market sentiment (and less focus?)

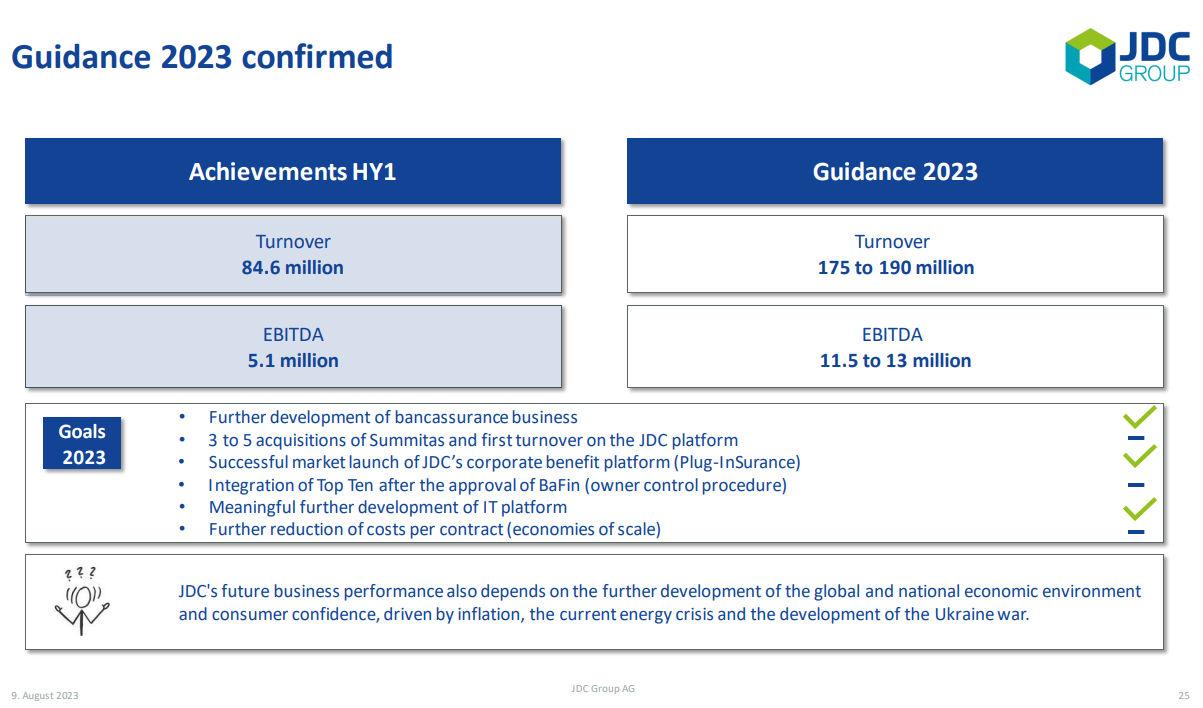

However overall, revenue growth is slower than expense growth (because Advisory (finance) segment is holding AdvisorTech (insurance) business back). We do fear the company might be too optimistic on the future scaling potential. Too be seen if expense growth is really limited when additional contracts & customers are added to the platform.

JDC Group is cashflow positive. Over 1H’23 it made EUR 4 mio operating cashflow from which EUR 2,2 mio was used for investment purposes. Note the recent sale of own shares (see further) to Provinzial will bring an additional EUR 13 mio. So cash levels should end up around EUR 30-40 mio by FY 2023

The company is currently valued at approx. EUR 220 mio (cash almost equal to debt). That is approx. 20x EBITDA. If these cashflows are used to fuel further growth (e.g. consolidating the broker market) then it’s OK to pay such a price for future growth. However if constant additional investments in IT & sales support seem necessary (e.g. increased expenses) we doubt if the hockeystick effect on EBITDA will be that feasible

Guidance for FY’23 has not changed, despite the slower growth in 1H’23

Full year 2022

Lower revenues than expected, but good cost control

In FY22, key clients generated nearly 20% of JDC’s total turnover and this percentage is expected to grow in the coming years. The onboarding of savings bank-related insurer Provinzial is gaining traction, especially at the large Cologne branch. JDC believes this should result in growth of more than 20% in FY23 for key clients (FY22: 27.6%). FYI - in an AUG 2021 interview, the company mentioned Provinzial deal will start in 10 bank offices, target 1m customers and has potential to reach 100m revenue by 2026

Life insurance activities suffered in Q422

Good cost control / stable cost structure, which allows to show real operating leverage. The more revenue added now, the higher the EBITDA margin will become. Note IT costs are around 7m per year

People

CEO & Chairman of the board = Dr. Sebastian Grabmaier

Studied law in Germany & Chicago. Started his career in 199X in lawfirms, and moved to Allianz (German HQ - worldwide insurer) in 1999. Met the former owner of JDC (Dr. Klaus Jung) at a sailingclub and got the opportunity to be part of the management buy-out in 2003. The company was at that time a venture of Deutsche Bank and focused on the digitization of the fund business.

@goodinvestingc made a nice interview with the CEO end of 2022:

CFO, CIO, COO = Mr. Ralph Konrad. At JDC Group since 2003. Prior experience at investment firms in Germany and partner at Heliad Equity Partner GmbH

Chief Digital Officer = Mr. Stefan Bachmann. Ex-Google manager. Recently announced to leave JDC Group at end of 2023 on his own demand. Helped lay the foundations of the bancassurance partnerships. Marcus Rex will take over his responsibilities. Marcus comes over from competitor Hypoport SE (see paragraph “competition” below)

Shareholders

Main shareholders are

Great-West Lifeco: 26,9 %

Management (split between Grabmaier & Konrad): 11,1 %

Versicherungskammer Bayern: 6,0 %

JDC own shares: 5,0 % → Sold end of SEP’23 to Provinzial at EUR 19 per share

And a 51% freefloat

Management owning a significant percentage of the shares is a powerful alignment of interests. There are a total of 13.7m shares outstanding and this amount has been stable for some time. We like growth companies that refrain from diluting their shareholders

Earlier in 2019, mgmt. cashed in a part of their shares in the sale to Canadian Great-West Lifeco (via their Irish subsidiary). Great-West was convinced of the technical knowhow of JDC Group towards brokers (a focus distribution channel) and is also active in financial services

The own shares bought back have an avg. cost of € 7.06/share, again showing a good shareholder remuneration mindset. These were sold to Provinzial at €19.00/share, which will provide the company some nice additional profits. It will use the proceeds to finance further growth.

Competition

Hypoport SE - Digitalising the credit, real estate and insurance industries

Hit by sluggish real estate market in Germany. For its smaller insurance business (many credit insurance linked to its mortgages), focus on cost control and revenue -15% in 1H’23

Thanks for this analysis !