Update - Direct Line Group ($DLG.L)

One of the UK market leader's in retail Motor & Home insurance

Conclusion

FY2022 results impacted by inflation (on Motor insurance - premiums on policies were priced too low) and heavy weather (on Home insurance), both effects should be countered by higher future pricing (adopted by the full market) but will take some time (min 1 year) to fully show in the results (e.g. Q1 ‘23 results still show 3/4th of ‘22 policies and 1/4th of ‘23 policies)

Solvency ratio is low (147%) and should be shored up by (1) less risky investments, (2) additional reinsurance and (3) retaining future profits (i.e. no dividends in 2023). Although if further hits come out of the investment portfolio, an equity increase is not off the table (current capital surplus is only £570m). If financial markets stabilize, some nice gains are possible (pull-to-par effects).

Commercial (i.e. small SME’s) insurance is a potential growth pool for Direct Line Group.

Expenses are under control.

Long term earnings potential lies around £300-400m (see detailed analysis below). Ranging towards the higher end if interest rates leave the negative/zero range for good. At current £1,8 bio market cap (or 140GBP/share), that’s 6x-4,5x P/E. Direct Line is a market leader in retail insurance in the UK. Yes, Admiral is the market winner, but there will always be room for 2-3 large players.

Conclusion: $DLG.L is probably undervalued at current point (£140/share), but holds a low growth perspectives and even some LT risks (self-driving cars impact on Motor insurance?) and ST risks (further declines in real estate prices). A small trading position could work to capture a rebound to £160/share, but this company does not receive a position in our main portfolio.

Update 20 APR - sold at £168/share today, captured a quick 25% rebound and now waiting for further inflation to work through the Motor insurance policies (UK inflation still sky high). Expecting to see some slowdown at 9th May trading update, higher prices = more customers going elsewhere.

Analysis

Company overview:

FY2022 results

Going over Direct Line Group’s (DLG) different business lines:

Retail Motor Insurance → inflation effects were not priced in. Basic principle in insurance is you take the money (premium) up front, and over the policy length (typically 12 months) you pay for the claims incurred. Inflation was estimated too low at the start, and the industry now needs to catch-up with price hikes. Every non-life insurer in the UK is working to increase prices, although the customers opt for lower coverage, as ‘average written premium’ per policy remains stable. Over time, profitability should recover here should recover. Notice DLG does not have an expense issue (expenses stable / diminishing), just a pricing issue.

=> Profitability should improve with £200m here

Retail Home Insurance → bad weather effect were insufficiently priced in. Storm in Feb ‘22, drought in summer ‘22 and freeze in Dec ‘22 gave an abnormally high weather cost over FY2022. Again industry prices in general should increase, although one can question the lasting effects of global warming (UK prone to more unstable weather?)

=> Profitability should improve with £75-100m here

Rescue/Roadside Assistance → stable business. DLG owns a market leader with its Green Flag brand

Commercial Insurance → rather call it ‘small SME’ insurance (which is less volatile). Showing nice price increases and customer growth. Could be a future growth pool.

=> Profitability could improve with £25m here

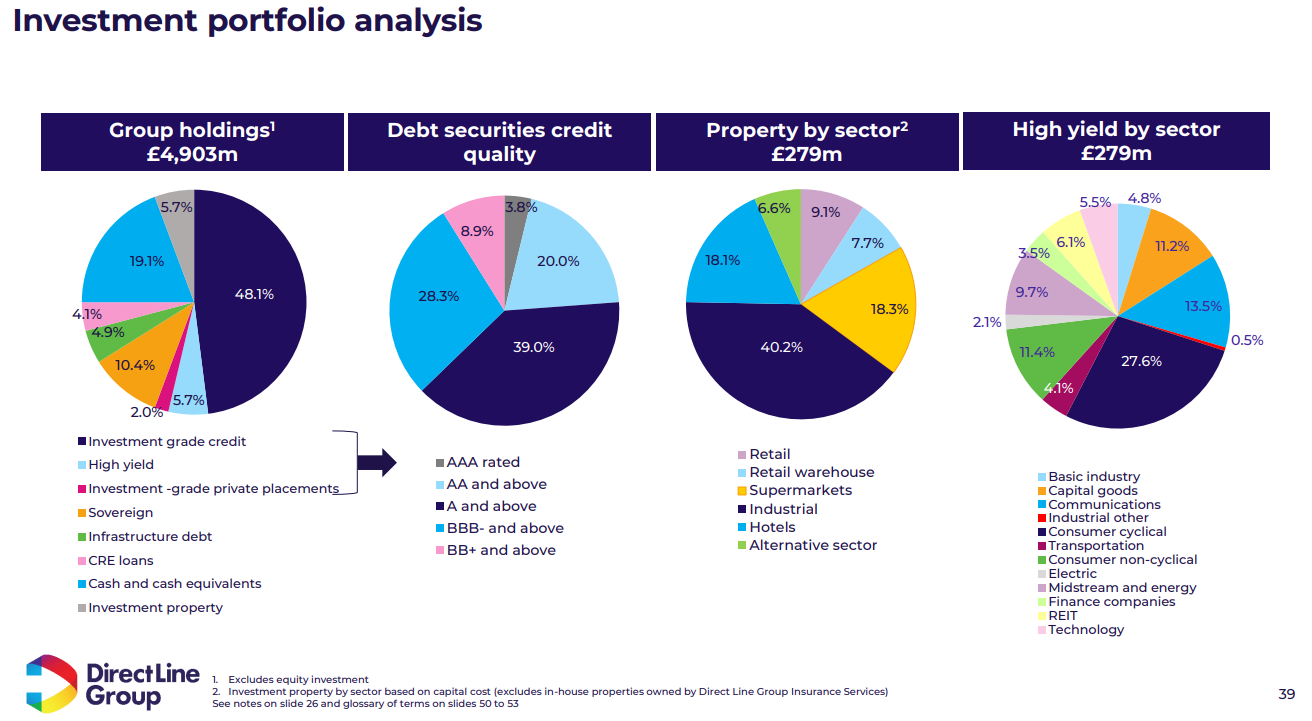

Financial investments → besides the ‘insurance profit’, insurance companies invest the upfront received premiums and earn a nice investment margin. DLG has a £5 bio investment portfolio, which is where the potential risks are located:

280m real estate → further devaluations necessary real estate investors are headed for the exits? (e.g. news concerning “gated” real estate funds). Part of their assets are in bad sectors (18% hotels, 9% retail)

200m commercial real estate loans

280m high yield bonds (mainly USD) → fixed rate bonds, haircuts needed because of high corporate spread risk? (27% consumer cyclical, 6% REIT)

2.350m investment grade bonds (mainly USD & fixed rate) → DLG was long duration at the wrong time (during fast rate hikes). It will take longer before high interest rates translate in higher interest income. Average duration is around 2,5 years.

Increasing interest rates already hit these valuations for 200m in FY2022 (unrealised losses, if no defaults occur, these amounts will be earned back due to the ‘pull to par’ effects).

The big question is how this will play out in next few years. In the long term, every +1% yield increase lifts pre-tax profits with £50m (current yield is only at 2%). In the short term, another -£100m losses is not off the table (pushing DLG further towards the need for a capital increase).

From FY2022 Investor presentation: