Digital Realty Data Centers ($DLR)

Disclaimer: This blogpost is for informational purposes only and should not be considered personal financial advice. The author is not a licensed financial professional and will not be held liable for any decisions made based on the information provided. We simply want to take you along the journey we are making ourselves. Investing comes with inherent risks and you should perform your own research before making any investment decisions.”

Executive Summary:

EBITDA is not the right metric to use for a Data Center company. We think DLR is assigning too long lifetime value towards its capex. The world of tech evolves so fast you will not be able to keep your current infrastructure for the next +10 years. Hence these companies are capital-intensive tech service companies, not traditional landlords. Depreciation is a real expense, given rapid obsolescence in data network hardware

Return-on-Invested-Capital (ROIC) keeps on decreasing to currently only 2.5% ! Which is exactly the Cost of Debt today (and which keeps on increasing). This means DLR is not capable to earn enough to remunerate its shareholders (Cost of Equity should be at least +10%). And probably as from 2Q23 will not earn enough to cover its Cost of Debt.

S&P rating agency has noticed the deteriorating financials and has a negative outlook on DLR’s debt with a current BBB rating

Cashflow is negative, meaning DLR is searching for ways to maneuver:

Raise more debt🏛 is difficult with a BBB rating + negative outlook

Selling buildings🏢 is difficult in this market. The latest sale was done with in essence DLR guaranteeing the buyer a minimal return on his investment

Raising equity💰 which it has done in beginning of the month June for $1b. Notice a quarter of the newly issued shares is still to hit the market

Lots of turmoil in the c-suite with 4 leaves in past months. Insider sales are negative, as expected. Any level above $100 is utilized to sell.

Conclusion: Its all about what ‘cap rate’ is currently assigned to the buildings & locations. At a 7 cap, which is our rough estimation reflecting the current market, this would value DLR 0.00%↑ equity at $72. Current $115 share price is a +60% overextension. Probably driven by large ‘AI investment flows’ over the last months which buy anything AI related disregarding the company specifics (e.g. current data centers are not fit for the new hardware). We are short an aim for a sub $90 level.

Analysis:

Activities & strategy

Largest owner of ‘digital infrastructure’ (i.e. datacenters) both for corporates at their own premises, as for '‘hyperscalers’ (i.e. the Amazon’s & Google’s of this world). Active across the globe. Started from USA, and grew worldwide through acquisitions.

Mainly owning their sites (i.e. very capital intensive + a highly leveraged ‘gamble’ into what will be necessary in the medium & long term with regards to datacenters)

No special items in their strategy:

Grow amount of customers

Improve internal efficiency

And be on top of their balance sheet (as large investments are required)

Financial analysis

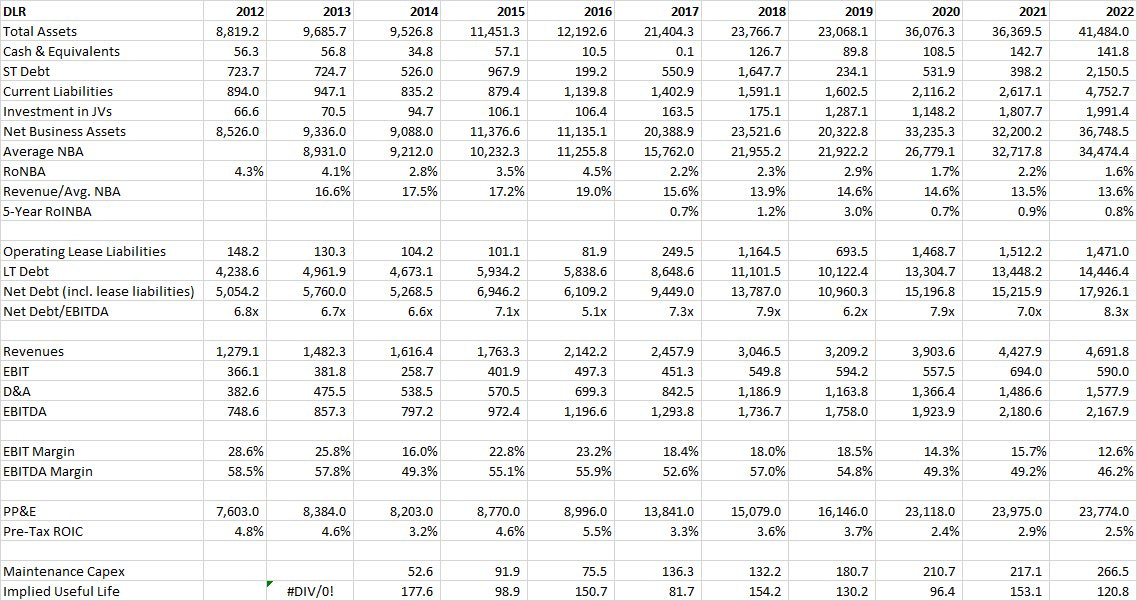

A typical REIT with a heavy balance sheet of $42b, funded with LT debt for 42% and rest in equity. Lets highlight some interesting numbers from the table above:

Gross yield (i.e. the income DLR is able to charge on its property & hardware) is declining and currently around 13,6%. A decline as such could be expected, as financing costs have declined also over the years (i.e. the company needed to charge less to cover its costs)

However, at the same time the company increased its leverage ratio (Net Debt / EBITDA) went up to 8.3x. With this heavy indebted balance sheet it entered the current period of increasing interest rates…. Luckily maturities are relatively well spread (see below) although DLR does have exposure to floating rates for 20% of its debt. Meaning its cashflow will be further lowered with $-100m in FY23.

FYI, current cost of debt is 2.4%

The company is not hiding its declining performance (although its trying to polish the ratio’s a little by using Adjusted EBITDA).

Note EBITDA is not the right metric to use for a Data Center company. Our analysis will show DLR is probably assigning too long lifetime value towards its capex. The world of tech evolves so fast you will not be able to keep your current infrastructure for the next +10 years! It will become obsolete much faster (who uses an iPhone 5 today? Those were released 10 years ago too). Read what Nvidia has to say about Data Center requirements to be able to work with AI GPU’s.NVDA CEO says DCs must upgrade for AI

So these companies are capital-intensive tech service companies, not traditional landlords. Depreciation is a real expense, given rapid obsolescence in data network hardware (dixit @WallStCynic)

Back to some metrics on our initial table:

Return-on-Invested-Capital (ROIC) keeps on decreasing to currently only 2.5% ! Which is exactly the Cost of Debt today (which is increasing). This means DLR is not capable to earn enough to remunerate its shareholders (Cost of Equity should be at least +10%). And probably as from 2Q23 will not earn enough to cover its Cost of Debt.

Which is quite visible when you look at the Cashflow situation. DLR is currently burning $300M per month, or $3.6B annually after dividends. Pretty strong evidence that they aren’t even remotely earning their cost-of-capital. Only a handful of solutions are possible here:

Raise more debt 🏛 → which it has done over 1Q23, but with a BBB rating and already decreasing debt ratios (as mentioned above) it cannot push that much further.

Sell existing buildings 🏢→ which it is trying to do. They are currently selling legacy assets, just to cover interest+dividend payments. However, current economic environment does not favor large REA transactions (high interest rates, low financing appetite from banks). DLR set itself a target to raise $500m by selling assets.

Sell new equity 💰 → which it has done in beginning of the month June for $1b. Notice a quarter of the newly issued shares is still to hit the market.

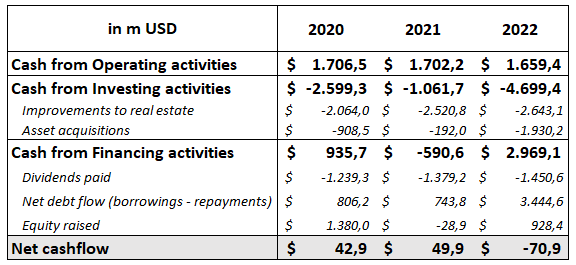

The current state of cashflow can also be seen in below table

Operating cashflow is not increasing much (despite $6b more assets over the 2 years). And the operating cashflow barely covers the dividend payments.

Any additional investment (improvements & acquisitions) were made by adding more debt and raising equity

Also S&P rating agency has noticed these deteriorating financials and has a negative outlook on DLR’s debt with a current BBB rating

Two financial side remarks:

$DLR’s Singapore spinoff ($DCRU.SP) is near its all time low, and is now trading at an implied 10 cap. It has the same legacy assets as its parent

Besides real estate, DLR is also slightly exposed to Europe’s energy market. With only a 56% pass through rate of energy prices in it’s EMEA region.

People

Lots of turmoil in the C-suite:

CEO A. William (Bill) Stein announced on Dec 13th he will resign effective immediately. Bill had a longstanding history with DLR, being CFO and CIO before becoming CEO in 2014. Bill was replaced by Andy Power, CFO since 2015.

COO Erich Sanchack (started in 2018) was let go in Feb 2023 in a company reorganisation. No replacement announced

CRO (revenue officer) Corey Dyer who only joined DLR in 2021 will terminate ‘without cause’ end of this month. No furher explanation given (only two years of service?). Corey will be replaced by Colin McLean, former USA sales lead.

CIO Ed Diver (55y old) mentions on his Linkedin page he is retired since Apr 2023. No official communication from DLR on this though.

Insider sales are negative, as expected. Any level above $100 is utilized to sell.