Disclaimer: This blogpost is for informational purposes only and should not be considered personal financial advice. The author is not a licensed financial professional and will not be held liable for any decisions made based on the information provided. We simply want to take you along the journey we are making ourselves. Investing comes with inherent risks and you should perform your own research before making any investment decisions.”

Executive Summary:

+ Steady & controlled growth (+20 sales points a year). Good track record with franchisees (despite seeing a first impairment of franchisee receivables in FY23). Sees potential to reach 400 units over time in the UK (+100% growth vs today)

+ Invested in its capabilities during the previous years. Capex will slow down leaving more Free Cashflow available for dividend distribution and/or buybacks

+/- Main risks are operational (e.g. bad food) and fixed costs inflation (mainly wages). We saw expenses increase significantly in FY23 in order to restore accounting mistakes found in financial reporting. These mistakes were not misleading or malicious by nature, but can likely be attributed to understaffing and under investments in the Finance department over the years. Both are restored (e.g. new CFO, +10 admin FTE’s, new auditor, etc) and the large increase in ‘professional expenses’ probably refer to this. We expect these expenses to normalize in the future and confidence to be restored.

+ Other market parties clearly see value in the company as Cake Box received an unsolicited offer from an Australian Private Equity to take the company private at £ 64 mio (or 160 GBX per share). Cake Box rejected this offer considering it ‘materially undervaluing the company’

+ All value metrics point to a healthy company, with shareholder remuneration as a focus point (the CEO earns 3x more on yearly dividends than his salary)

Conclusion: We are a buyer (together with mgmt.) for a first position at 150 GBX or lower. The company suffered some confidence issues after accounting irregularities. Macro economics could create harsh operating environments in the near future (consumer spending slowdown, slower new franchise growth). But the growth & potential stays present (cfr the private equity offer). At 9x EBITDA or a 10% FCF yield valuation is reasonable and not yet taking into account future growth

Analysis:

Activities & strategy

Cake manufacturer started in 2008, IPO in 2018

Does not own stores, only central production & warehousing units. Works purely on franchise (240 units → 205 stores & 35 kiosks) which was built out over 15 years with +20 stores / year added last year. Franchising allows the company to grow without too much capital consumption (and keeps the fixed costs in check).

Offering a simple, yet profitable partnership to franchisees

Cake Box is active in all main UK cities, but sees expansion possibilities till 400 units in total (almost 100% growth vs today)

The company makes money on

Selling products (sponge / food items / fresh cream / accessories)

Taking a commission on centrally steered online sales to local franchisees

Receiving a start-up commission on newly opened franchises

Online sales are approx. 20% of total sales (and need some marketing investments)

They have a simple & efficient website (chose, order, pay)

78% of their reviews on Trustpilot have a 5-star rating

They offer home delivery, which is notoriously difficult to get profitable. Luckily Cake Box does not operate this themselves but cooperates with Uber Eats & Just Eat to make the last-mile delivery

An additional benefit of the business model is its negative working capital As customers pay their order directly, but the company can work with regular payment terms towards its suppliers, this means the more the company grows, the more cash it can extract from its operations

Financial analysis

I believe its required to start off this chapter referring to the accounting issues found by blogger @MaynardPaton earlier in 2022. I strongly advise to read his original blog post

Maynard mentions:

Oh dear. I had expected this article to celebrate a dynamic growth company that had commendably prospered during the pandemic. I find myself instead relaying some unusual financial reporting after digging deep into a few annual reports.

Multiple accounting irregularities were found (e.g. inventories), restatements were done over the years, their previous auditor resigned, etc. However, none of these accounting irregularities point to malicious interventions and/or ‘cooking the books’. It are mainly inconsistencies which probably point to under investments in the Finance department and the company growing too far above its admin capabilities over the past years.

Cake Box reacted by hiring a new CFO, appointing a new auditor, and adding +10 FTE’s to the admin functions. We also assume the steep increase in ‘professional expenses’ point to a catch-up & restoring of the proper finance processes and systems.

Like-for-like sales by franchisee were up +1% vs FY22

(H1 was down with -1.6%, but recovery in H2 with +3.4%)Management added during the presentation:

The Board is optimistic about the prospects for the year ‘24 and the sales performance continues to be robust, with franchise sales up 5.4% like-for-like in the last 11 weeks

As mentioned above, expenses saw a large increase in FY23. Yes, the UK experienced high wage inflation, but also 10 FTE’s were added in the admin department (restoring processes after the finance mistakes found in FY22 - see above).

£ 0.9 mio of these rise in expenses are due to added ‘professional costs’. We expect these to be one-off in nature (e.g. consultants helping with a catch-up in the finance department, hiring fee’s for the +11 FTE’s, etc)

Free cashflow is largely sufficient to pay the current dividend (50% payout ratio) and make quite some Capex spend (of which £1.1mio was spent on distribution centers improvements). The company signaled Capex would be lower in future years. We assume it will go back to approx. £1mio a year like previously again adding £ 1 mio to Free CF.

If we were to make a projection for next years:

Operational Cashflow (excl one-off working capital boost) is £ 6.5 mio and growing thanks to units added

We expect expenses to be more in line next year which could further increase the operational CF with £ 0.5 - 1 mio

Investment Cashflow (i.e. capex) will revert back to £ 1 mio

Which leaves £ 8 - 8.5 mio cashflow to service debt interest and repayments (approx £ 0.5 mio), leaving £ 7.5 - 8 mio cashflow for shareholder distribution / future growth. At a £ 64 mio market value, that’s a 12% yield

The balance sheet is fairly simple

No big intangibles

Some small loans to franchisees

Net debt is positive, debt is only used for the warehouses and machines are leased

There are no extremes in payables and/or receivables outstanding

And there is a healthy cash position of £ 7 mio

Cake Box provides loans to franchisees (£ 0.75 mio). The loans are unsecured but if loan repayments are not kept up, supply of product is stopped. The company has the option to resell the franchise to another interested party with the purchase price being used to first repay the loan and any outstanding trade receivables. FY23 was the first time to see an impairment (£ 230 k) on franchisee receivables. Given the limited amount in loans outstanding, we do not expect this position to trouble the companies should any other franchisees experience financial difficulties.

People

Executive Directors have all previously run their own franchise stores. There are lots of people with experience from Domino’s (which can be considered the reference in the franchisee business model)

CEO & Co-founder (Chamdal) is 61 years old and opened the first Cake Box concept store in 2008

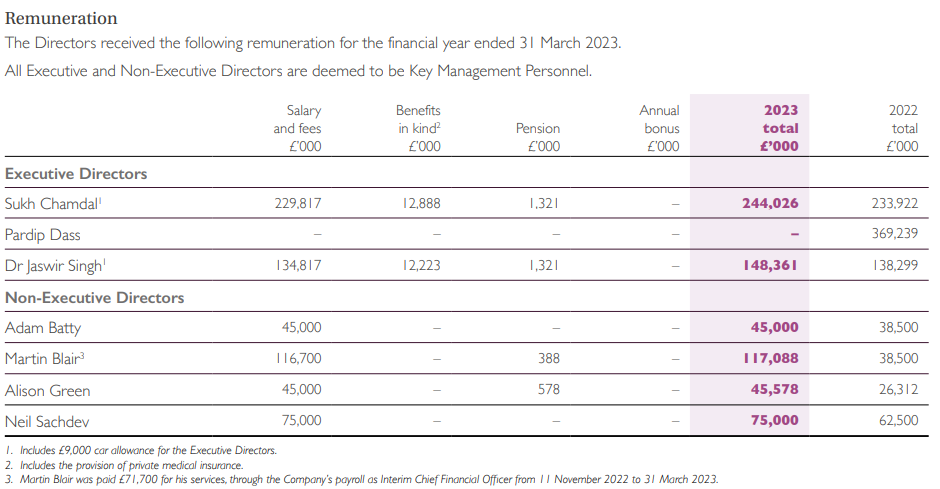

Remuneration of the executive team is market consistent. Bonus payment is based on an EBITDA target and some strategic milestones. As EBITDA dropped below the target for FY23, no bonus was payed. Clearly no signs of trying to serve themselves at the expense of shareholders. Note the CEO earns 3x more on yearly dividends than his salary.

Insiders (CEO) were buying at recent low share price levels of 139 and 122 GBX

Shareholders

CEO & Co-founder still owns 25% of the shares (10 out of 40 mio shares in total). Two large blocks of 3.75 mio and 3 mio shares were sold by him earlier in 2020 and 2021. Given his age (61 years old) we can expect further selling in the future should the shareprice reach higher levels (although he bought recently in smaller size at low levels). Maybe the recent unsolicited offer by an Australian PE company can kickstart discussions to sell his remaining stake?

Rest of the shareholders are smaller asset managers, the company is too small in size for the bigger asset managers to spend time on

There is no additional dilution like warrants, options, etc (which is a plus)

Thanks for reading! Subscribe to receive new posts and support my work.