Atenor ($ATEB.BR)

European Office Real Estate Developer with 1 bio in stock finding it difficult to sell in current markets.

Conclusion

Grew balance sheet during low interest years (and payed high prices for new projects?). Building project inventory grew from €775m in FY20 to €962m in FY22.

Balance sheet is stretched in terms of leverage (21% equity, net debt of €867m). Only option is stopping the expenses (i.e. no startup of new projects - FY22 was already minimal) and hoping for a good sales environment window to offload existing projects (in the meantime holding them on balance sheet).

Cash levels are already low at €25m, and minimal yearly expenses are €60m (= operating €40m + financial €20m and rising). Leasing income at €5m will not cover.

If this good sales window does not arrive soon (Hello US & EU banking doubts?), the company will be forced to sell some properties at suboptimal value. We will soon find out how much buffer there is left on the ‘accounting value’ of the stock. Two options are possible

Or it will realize low margins, but still be able to make a margin over debt → slow deflation of equity value since there is little room for new projects

Or it will realize negative margins, which could trigger a forced equity increase to shore up the equity buffers (given current high leverage ratio)

Mgmt made no projections for FY23, but does expect to generate a cumulative €300m of gross margin by FY25 based on current pipeline / buildings kept in stock. (while I expect expenses at least to be €210m over this period)

Conclusion: worth a first short position. Central Bank cannot stop rate increases (high core inflation). US + EU banking doubts will trigger a slowdown in loans appetite. This increases lending costs for Atenor, but worst of all, it diminishes sales prices that buyers are willing / can pay.

Analysis

Business activity

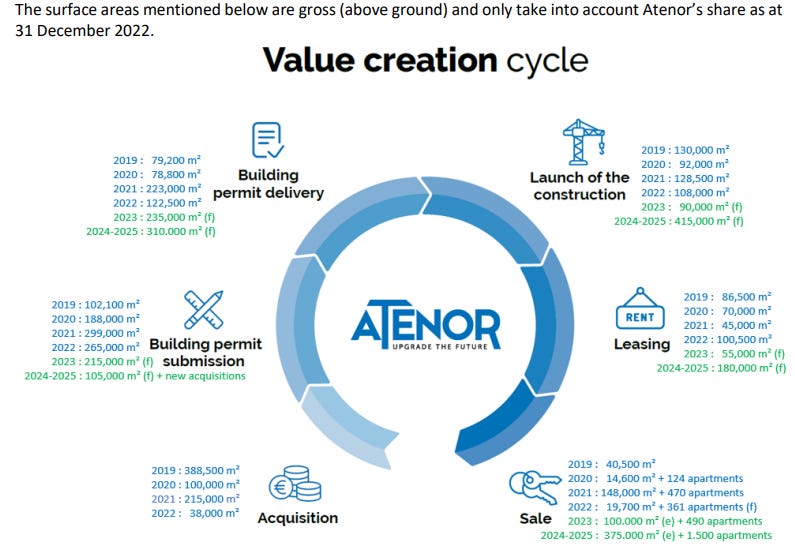

Buying building land → gaining a permit → launch & follow-up construction works (they are no contractor themselves) → populate the building with tenants → sell and make profits

Their properties are mainly offices, spread out over the capitals in Europe. Their team is nimble and concentrated in Brussels, Belgium (which means they rely heavily on local consultants to develop the projects → i.e. higher costs?)

Financial Accounts (latest is FY2022)

Sales came to a halt in 2nd half 2022

As can be expected, it are mainly the Central European countries experiencing difficulties due to high energy prices + Ukraine war (cfr heavy portfolio in Poland / Hungary / Romania). Buildings are just kept in stock for now (no write-downs → which could trigger a capital increase).

If no/low sales continue in FY23, their leasing income is really small (€4,7m in FY22) and will for sure not cover all expenses (€60m and rising). Let alone annual dividend payments at €18m.

Accounting tricks are starting to be used to keep the equity from falling further. Buildings are taken out of ‘inventory’ and placed as ‘LT investment’ for the first time in FY22. This will trigger an accounting gain (going from being valued ‘at cost’ to ‘expert valuation’) but has no impact on cash/cashflow.

Surely, it “may be sold” in the future. It was to be sold today if only there was a buyer at these prices…

Thought experiment: the expert valued the building at €21,3m, which is a €5,9m (or 38%) gain versus the €15,4m inventory value. Only caveat is that there was no real buyer at these prices (otherwise it would have been sold … Atenor has no history, nor purpose in keeping properties for rental income). Second caveat is this ‘Fair Value’ was determined with discount rates between 5,5% and 7%. Which is too low with ECB rates at 3-3,5%

Operating expenses are around €60-80m / year.

Lets assume there is a halt on new purchased projects (as in FY22) and startup costs & registration fees are stopped. Current projects in stock still require further development though. Lets be generous and say €40m / year is minimal.Financial expenses around €25m / year and rising

(2,3% in FY20 → 2,4% in FY21 → 2,6% in FY22)

Note the amount mentioned is higher then what is in the P&L statement, as part of the interest charges is ‘activated’ when the building is still under constructionLatest bonds (June 2022) were issued at 4,25%

Yearly dividend payments around €18m / year (at 2,54 EUR dividend / share)

Debt expiration is well spread over time. Only possible headwind is short term commercial paper €150m / short term loans from banks (€10m BNP + €60m Belfius) and €20m at expiration date in 2023. These €230m debts will reprice quickly and/or need to be placed in the market at higher rates. Every 1% interest increase adds €2,3m in yearly cash requirement.

Cash levels are very low at €25m, and as can be expected, the company will start lingering with its trade payables to keep up the cash amount. No further details were given on the sudden rise